The investment started around June last year, but I would like to continue investing in 2021.

I would like to write a diary as my memorandum, so thank you.

Last year’s investment results and considerations: Results + 38%

At the end of the year, there was a strong tendency for stocks to be down. But I didn’t sell it, I bought only GATOS SILVER that I wanted to buy.

As a result, the final asset volatility was + 38%.

Good thing this year

・ What I learned a lot about investment

・ Because I started after Corona, there are many stocks that are cheap, and most of them have recovered.

・ I felt the merit of purchasing information through You Tube (especially English channels)

What I learned this year

・ I want to diversify my investment, but I need some money to diversify.

・ Dispersion is possible by making good use of ETFs.

・ Loss cut is very important

That said, I ended up selling all the ETFs. I think this is just a matter of my taste, but it’s because the ETFs feel somewhat inorganic and the charts don’t feel warm. From the perspective of diversified investment, I think it’s okay to buy stocks at once.

Therefore, I think I will continue to buy stocks, mainly individual stocks.

It’s only information on the four seasons(Japanese SHIKIHO) and NET, but it’s fun to find a company that makes me want to buy this stock when you look at various company information. Is it because I am a beginner?

About the stocks held

The Indonesian stocks I bought at the end of last year have been lowered at the end of the year, and I feel that they have returned by the amount I lowered today.I learned from Indonesian stocks.

Currency fluctuations are large, which has a significant effect on the value of stocks as Japanese yen

It seems that the fluctuation is larger than the Japanese yen dollar. It is quite interesting that even if the stock price is lowered, it is positive.

So I’m thinking of holding it for a long time.

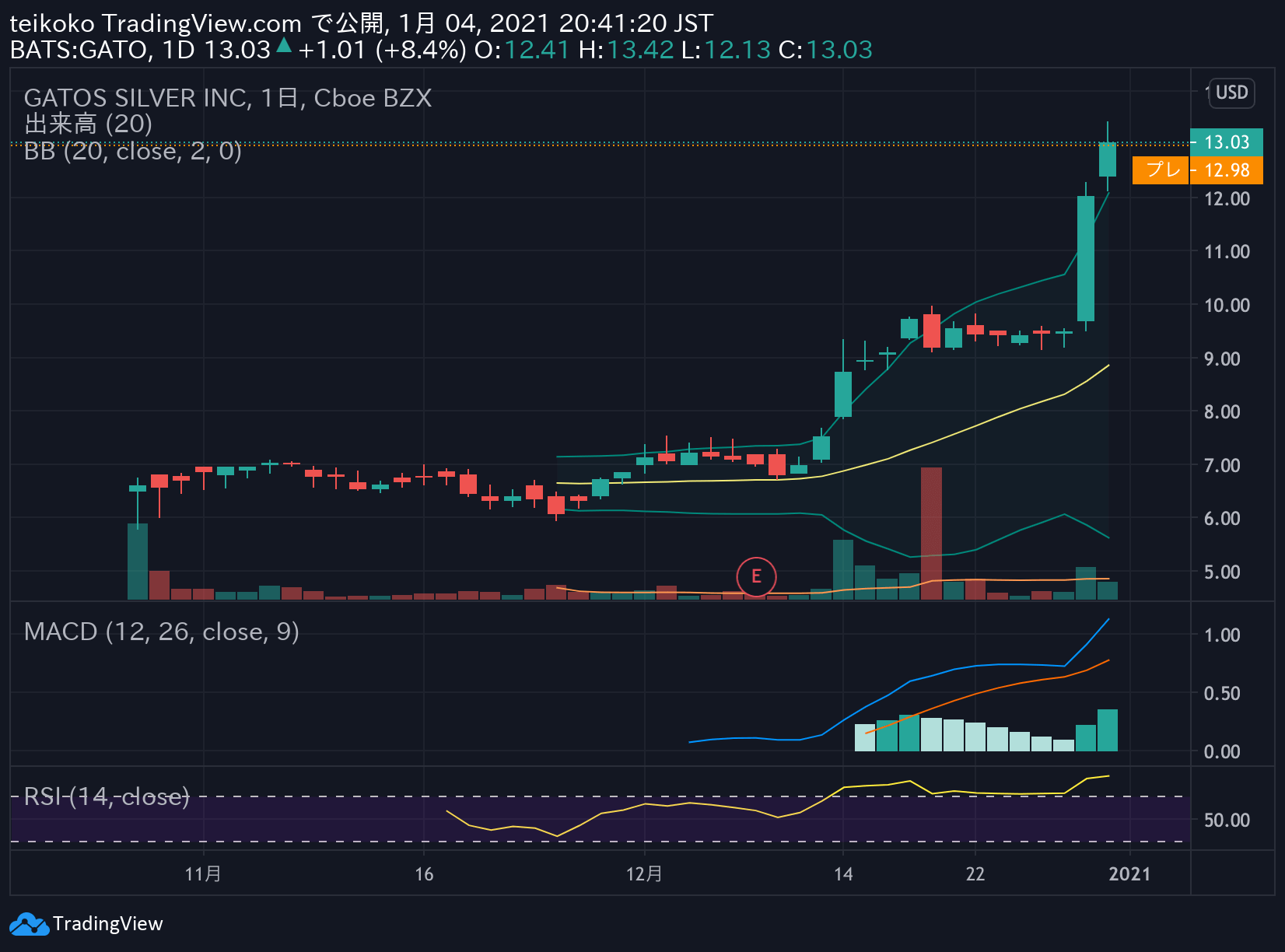

GATOS SILVER INC (GATO)

It’s the stock I bought at the end of last month. After I bought it, it went up suddenly, so I’m worried about price movements this year as well.

This stock is also an IPO, but I’ve been watching it for a long time because the name left an impression on me thanks to a certain anime.

The company is rare for an IPO, and I was also interested in silver mining. Like Indonesian stocks, I think I like minerals. Coal isn’t very attractive, but minerals are good. I feel that coal is energy, but is it suitable for the division of the market?

This year’s goal

I’m thinking of building a proper portfolio. In building my portfolio, I found good materials online, so I will introduce them if I am satisfied with them.