Now that this month's trading has ended on October 30, I would like to look back at the stock in October.

This month, the overall stock I have was on a basic down trend.

I think that it was good only to see the result that the loss from last month was not so big, but I feel that it was quite dangerous.

In Horiemon's video, there was something like "Invest in 300,000 yen? (laughs)", but I felt that Horiemon was right. In the video, he said, "It's not investment that you can't make a portfolio, it's speculation and gambling."

I feel that I am in my current state. I tried to create a portfolio that I would like to assemble, but I don't think I have the funds to realize it all at once.

Under such circumstances, I felt that there are many "value stocks" that I choose.

I love stocks that have a sense of afford. Even in the portfolio that I'm making virtual now.

Don't you sell long-term holdings?

When I talk about Horiemon, I feel that my investment is not yet at the stage of saying long-term or short-term.

However, there were quite a few questions.

For the time being, I try not to sell stocks that I bought with the expectation of holding them for a long time unless they are less than I expected to buy.

Sumitomo Corporation lost because it was lower than expected for the first time.

The other "Akatsuki" and "Marubeni" were going downhill for a long time in October, but I had them without selling them.

Although it is a result theory, I think that it was good to confirm the profit early, and to cash it at the time of the down trend.

As of the end of the 10th, profit and loss are still positive, but it is a disappointing chart.

Wouldn't you get lost if you had a solid portfolio in the true sense of the word and a policy of investment?

Even if it is decided that it is a long term, rotation and a certain degree of profit and brand change are necessary.

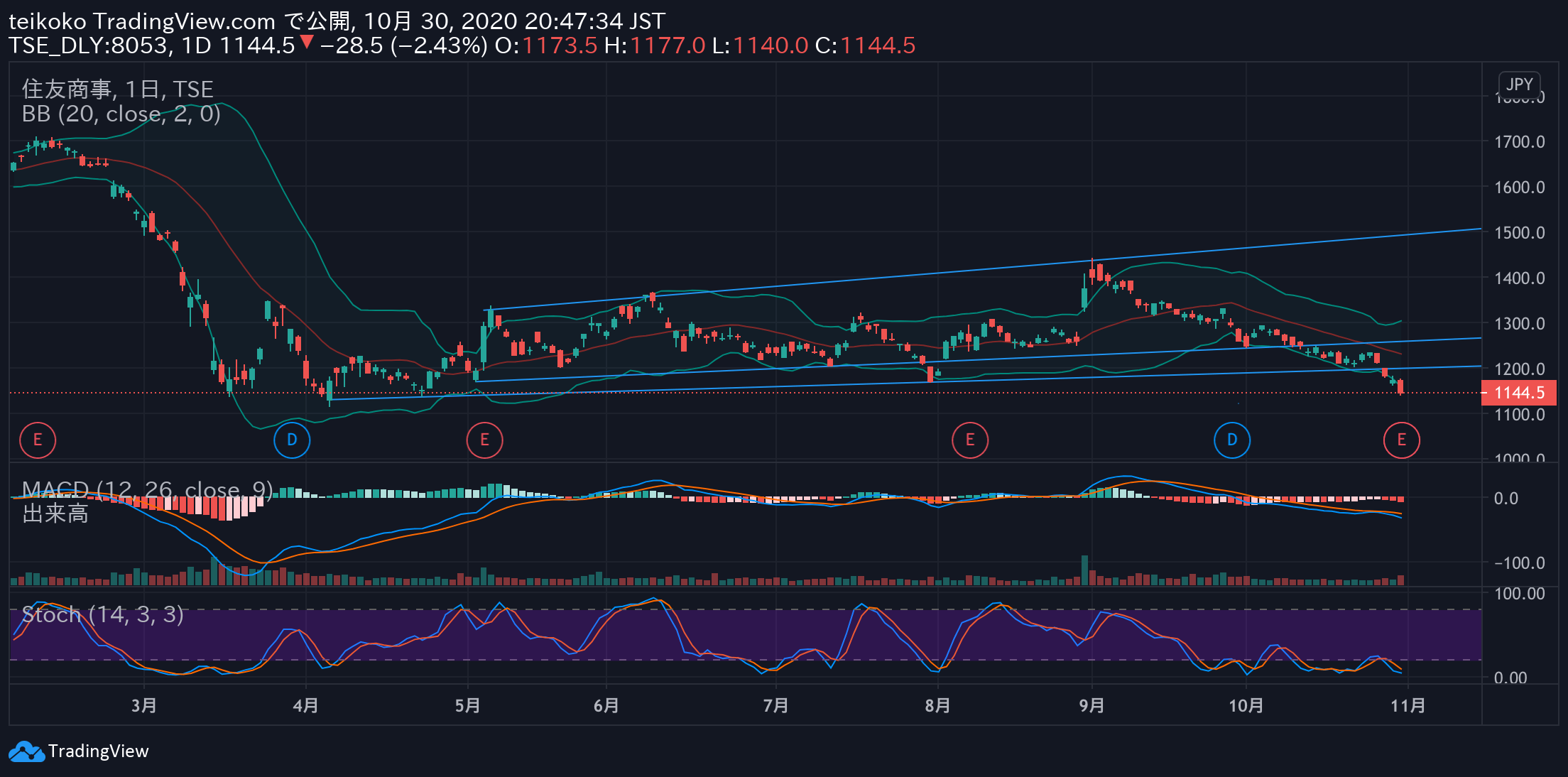

Sumitomo Corporation (8053)

The result was about 1300 yen and a loss cut at 1250 yen on 10/12. It was good to be able to cut the loss.

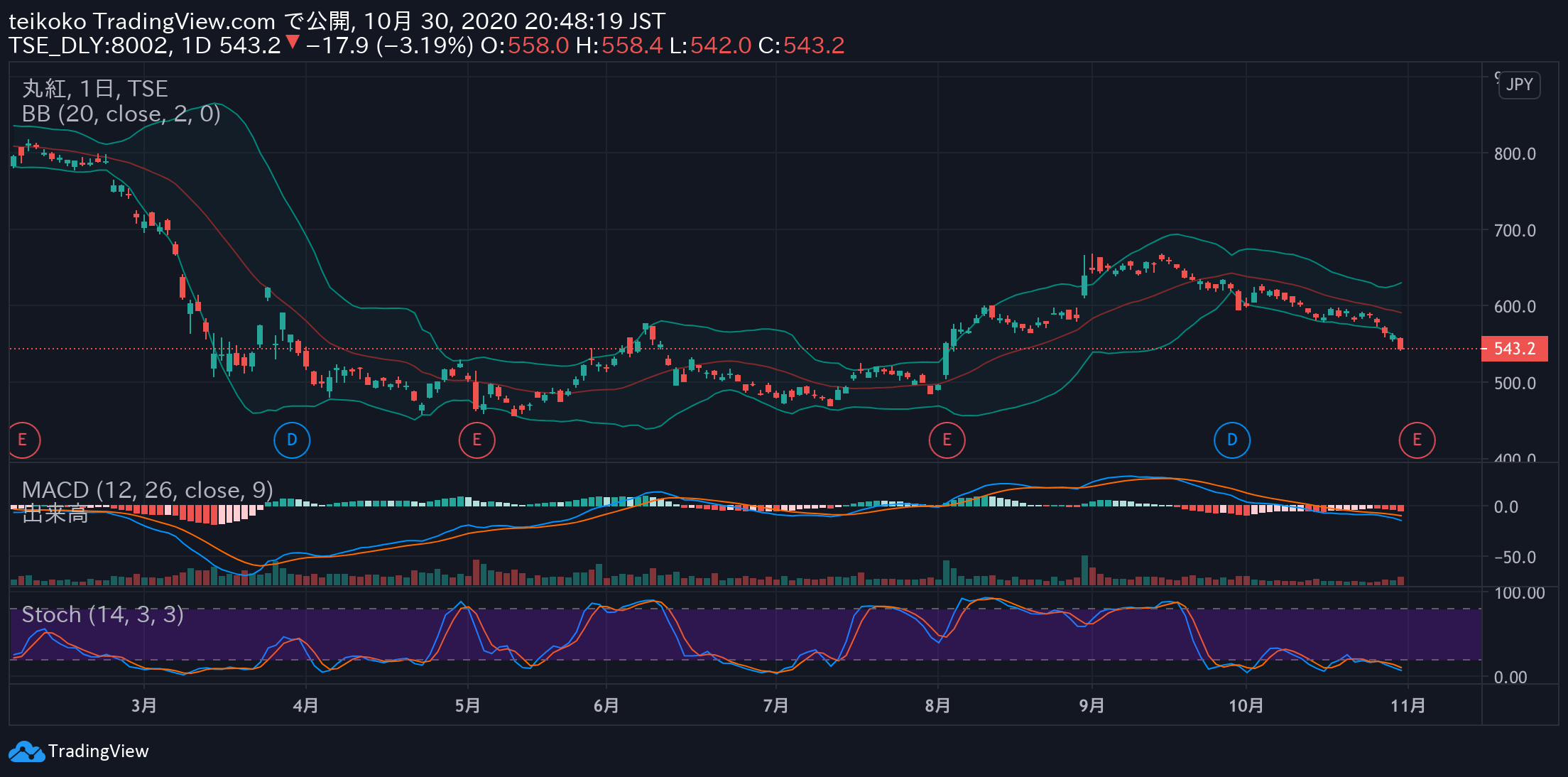

Marubeni (8002)

Marubeni is also downhill, but owns it.

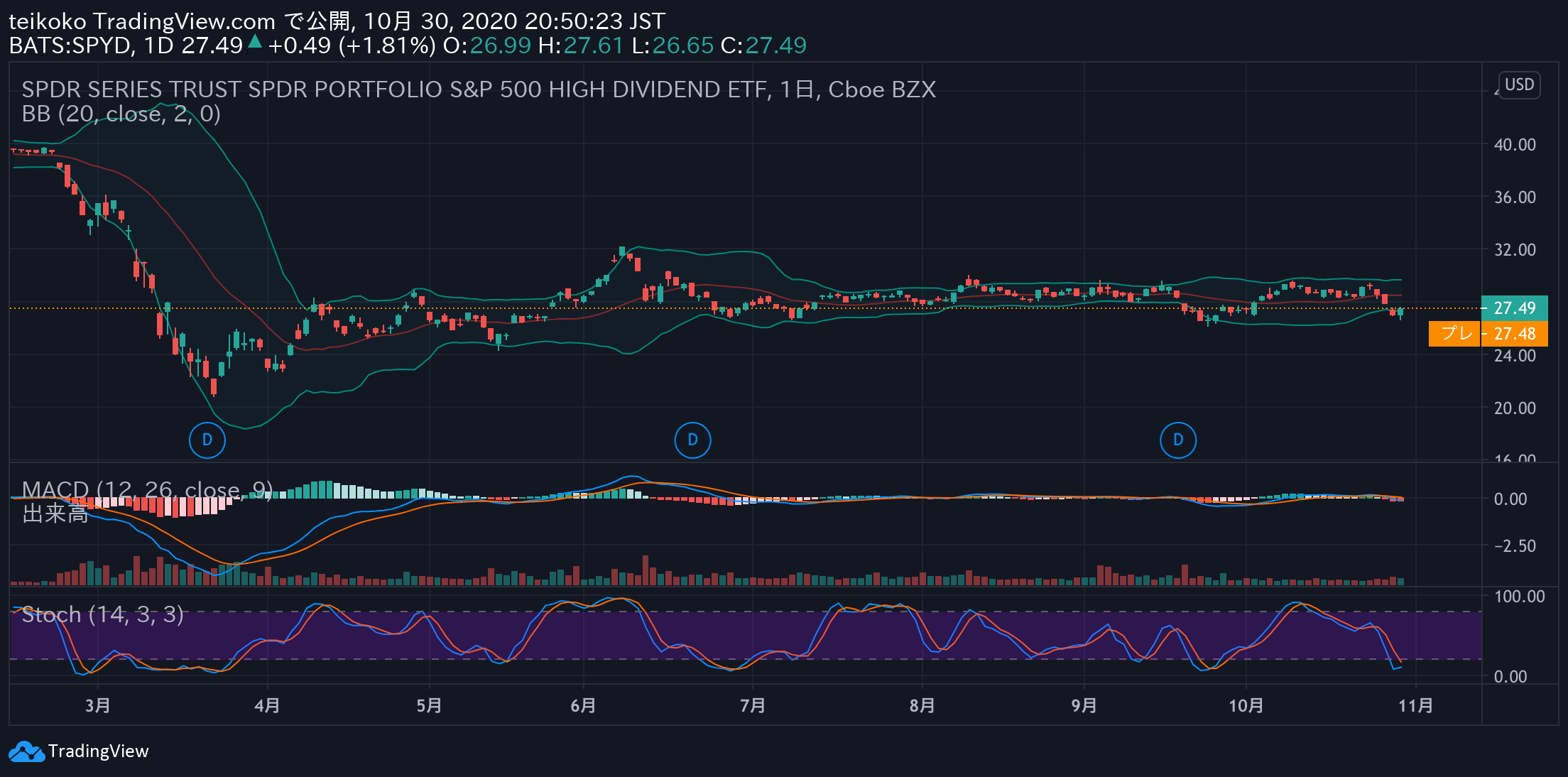

SPDR Portfolio S&P 500 High Dividend Stock ETF (SPYD)

I feel that it is cheaper than when I bought something here, but I leave it as it is because the quantity that I have is small.

I personally prefer individual stocks to ETFs. I feel that I have little interest in stocks if I can't see the company.

Stocks that you are going to sell after closing

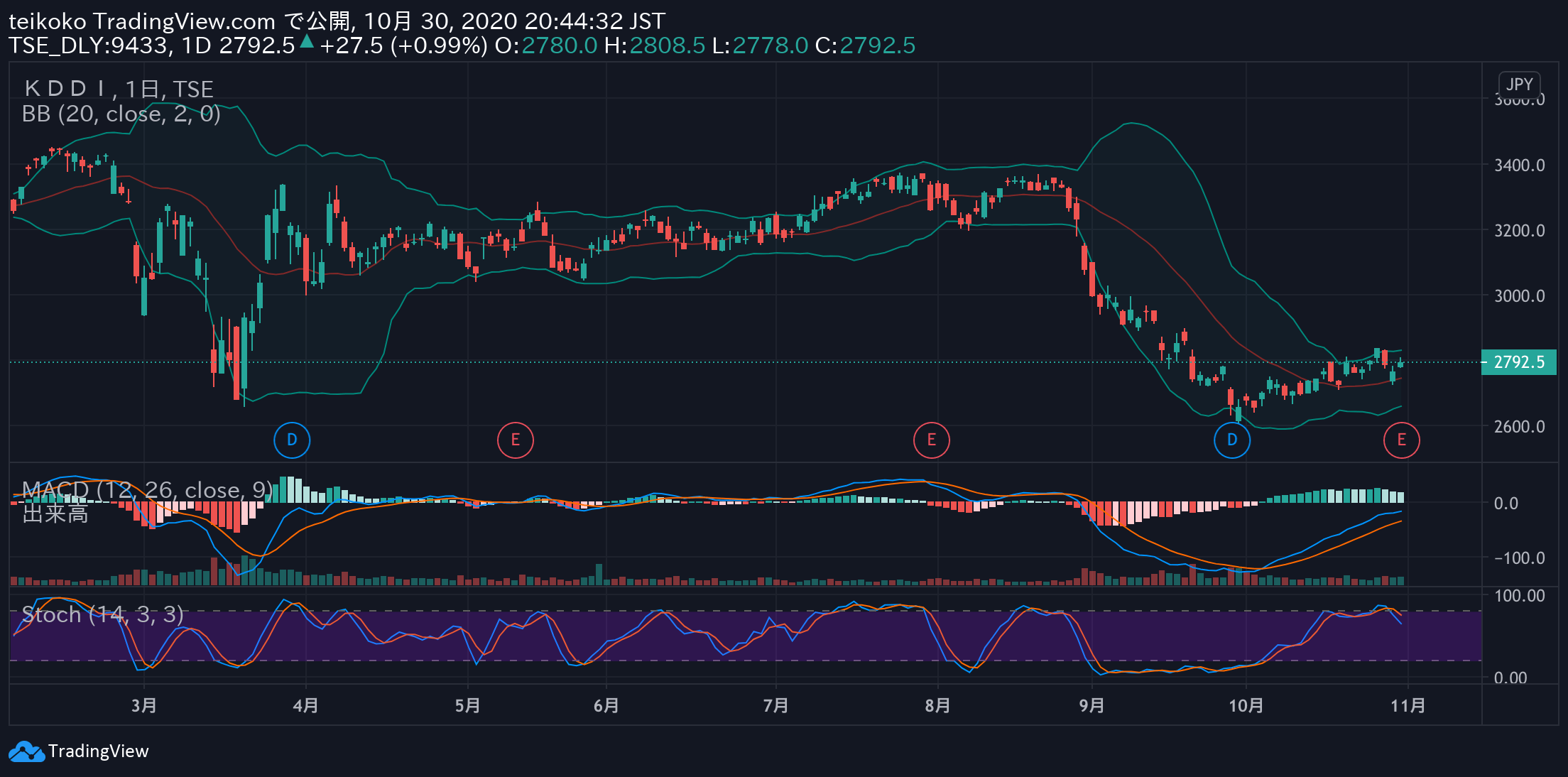

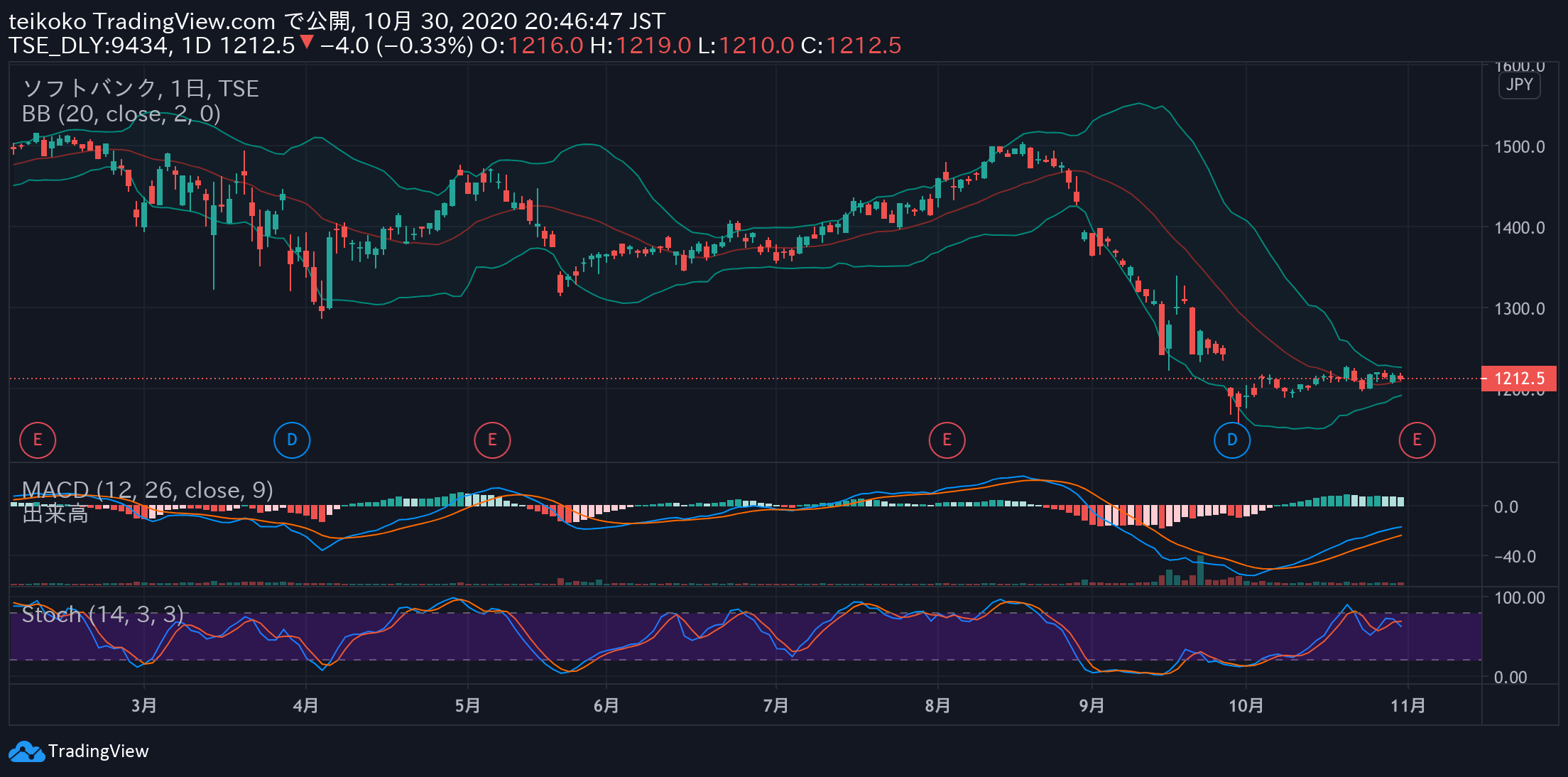

KDDI and SoftBank.

It is a stock that I think I will sell if I feel good after closing. On the other hand, if something is wrong, it's a loss cut.

From my point of view, KDDI's financial results announced today looked much better from the current stock price.

SoftBank would like to increase purchases depending on price movements. If I can buy it after the presidential election is over, I want to buy more.

I'm lucky.

This month, I was trying to buy Sumitomo Corporation, but for some reason I had a place called MEDRX for a while.

It feels like I bought it because of the news. It was very flat and uninteresting until about the middle of this month, and I sold it for a little plus money. But as of the end of October, the price has dropped considerably.

I’m glad I sold it early. I was lucky in that respect because the amount of loss cut would have increased if I had bought more Sumitomo as I had originally thought. I hope that KDDI will sell at a good price and I can buy cheap stocks now in November.